How to Verify a Contractor’s Insurance & Bonding: A Guide for Columbus, GA & Phenix City, AL

How to Verify a Contractor’s Insurance and Bonding in Columbus, GA & Phenix City, AL: Your Complete Guide to COI, Surety Bonds, and Peace of Mind

When you’re hiring a contractor for a renovation, remodel, or even general repairs, one question matters more than most: Is this contractor properly insured and bonded? It’s a question that not only protects your property but your peace of mind — and if you’re in Columbus, GA or Phenix City, AL, understanding how to verify a contractor’s COI (Certificate of Insurance) and surety bond is one of the smartest moves you can make before signing any contract.

This page will serve as your definitive, resource for understanding contractor liability insurance, verifying documents, avoiding scams, and protecting your home or investment project. We’ll even show you how to access our own verified documents right here on the page.

Why Contractor Insurance and Bonding Matters

In the construction and home remodeling world, things can go wrong: a subcontractor gets injured, a pipe bursts during a renovation, or a project is left unfinished. If the contractor isn’t insured or bonded, you could be left holding the bill.

A contractor who is licensed, insured, and bonded demonstrates professionalism, accountability, and a commitment to safety and compliance. When hiring a contractor in Georgia or Alabama — particularly in areas like Columbus or Phenix City — verifying these credentials is critical for both legal protection and project success.

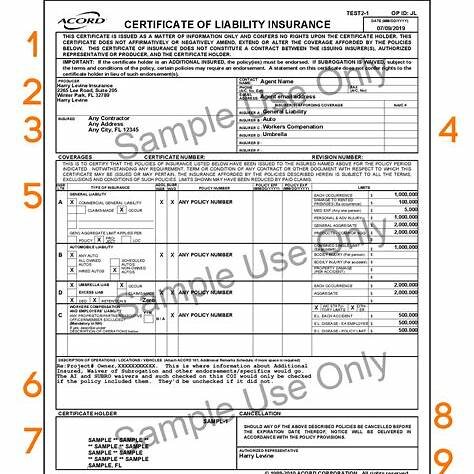

What Is a Certificate of Insurance (COI)?

A COI is a one-page document issued by a contractor’s insurance provider that confirms they carry liability insurance and, in most cases, workers’ compensation coverage. The COI includes:

- The name of the insured contractor or business

- Types of coverage (General Liability, Workers Comp, etc.)

- Policy limits and expiration dates

- Contact info for the insurance provider

- Additional insured options (sometimes available upon request)

Tip: Always verify the expiration date and ask the contractor to have their insurance agent send the COI directly to you. This ensures it hasn’t been altered.

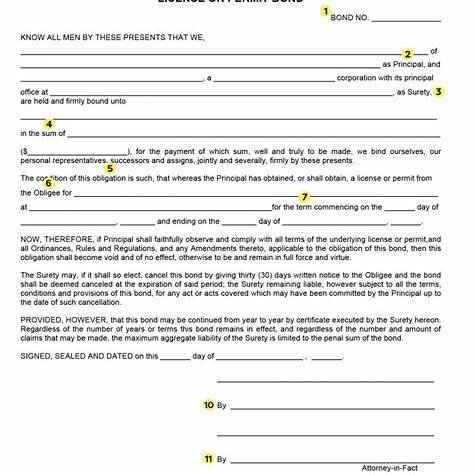

What Is a Surety Bond?

A surety bond is a financial guarantee that protects the client (you) in case the contractor fails to fulfill their contractual obligations. If the contractor abandons the job or doesn’t pay subcontractors, the bonding company may reimburse you up to the bond amount.

In Georgia and Alabama, general contractors are often required to carry bonding for larger or government projects — but even for residential work, bonding is an extra layer of assurance.

Step-by-Step: How to Verify a Contractor’s Insurance and Bonding

1. Request a Copy of the COI and Surety Bond

- Ask your contractor to provide their current Certificate of Insurance and, if applicable, their surety bond certificate.

- Ask for documents directly from their insurance and bonding agents whenever possible.

2. Call the Issuing Insurance Company

- The insurance carrier listed on the COI should have a phone number. Call to verify the policy is active and covers your project type.

3. Confirm Liability Limits and Coverage Types

- Ensure the general liability policy is at least $1 million per occurrence.

- If workers are involved, ask if workers’ comp is included (especially important if subcontractors are used).

4. Verify Bond Information

- Contact the surety company to confirm the bond is valid, and the amount is appropriate for your project’s scope.

5. Check Licensing

- For Georgia: Use the Georgia Secretary of State License Lookup

- For Alabama: Use the Alabama Home Builders Licensure Board

Why This Matters for Homeowners and Investors in Columbus, GA & Phenix City, AL

In these growing Southern markets, real estate and construction work are on the rise. That also means more unlicensed, uninsured “contractors” are popping up — and scamming clients out of thousands of dollars. We’ve seen it firsthand.

For homeowners:

- Protect your home from potential lawsuits, damages, or unfinished work.

- Avoid out-of-pocket liability if an injury or accident occurs on your property.

For investors:

- Safeguard your project budget and timeline.

- Preserve asset value by working only with compliant, professional teams.

View Our Verified Documents

We’re transparent about our qualifications. At A to Z Workmen, we proudly share our documents:

Final Thoughts: Hire Smart, Stay Protected

Hiring an uninsured contractor can cost you everything. But doing your homework — by verifying insurance, confirming bonding, and demanding written agreements — can make the process safe, smooth, and successful.

In Columbus, GA and Phenix City, AL, A to Z Workmen is proud to lead the way in transparency, safety, and quality contracting. We invite you to explore our portfolio and learn why so many homeowners and real estate investors trust us.

Need a Quote from a Fully Insured and Bonded Contractor?

Request an Estimate Here